Have you found yourself wondering which money transfer company will work best for you? Whether you want to send money from the Czech Republic or need to receive money from another country, you get several alternatives from which to choose. After some accurate researches, we can definitely recommend TransferWise as one of the best providers for this type of services! The company – already mentioned in one of our former blog-posts – has grown quite impressively during the last years and now has offices in the U.S., Hungary, Estonia, Australia, Singapore, and Japan. Without mentioning the UK, where its headquarters are based.

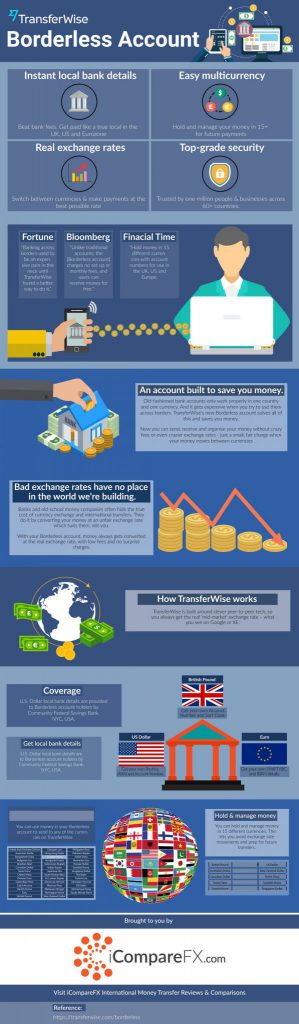

After the success of the Facebook Messenger integrated TransferWise Bot for its customers in the UK, Europe, the US, Canada and Australia, the company launched the Borderless Account. In its current form, you’ll benefit by using it as a freelancer, a business or an online seller.

Let’s now describe TransferWise in a more detailed fashion.

What You Get

After registering, TransferWise will give you local bank account details for the UK, the European Union, and the US. This gives you the possibility to receive payments in British pounds, euros and US dollars without paying any extra fees. Then, you get to choose whether you want to hold the money in your TransferWise account or withdraw it into your local bank account.

And it doesn’t end up here! Another feature of the TransferWise Borderless account is that it lets you hold and manage your money in up to 27 currencies. This way, you can protect yourself from unfavorable fluctuations in exchange rates and also make transfers in the future with ease. The fact that you may transfer funds out of your Borderless account to more than 50 countries in their local currencies is an added advantage.

Here’s the list of currencies TransferWise lets you hold in the Borderless account:

- Australian dollar

- British pound

- Bulgarian lev

- Canadian dollar

- Croatian kuna

- Czech koruna

- Danish krone

- Euro

- Georgian lari

- Hong Kong dollar

- Hungarian forint

- Israeli shekel

- Japanese yen

- Mexican peso

- New Zealand dollar

- Norwegian krone

- Peruvian sol

- Polish zloty

- Romanian leu

- Singapore dollar

- South African rand

- Swedish krona

- Swiss franc

- Turkish lira

- Ukrainian hryvnia

- United Arab Emirates dirham

- US dollar

How Much Does it Cost?

Good question! Signing up for and maintaining a TransferWise Borderless account doesn’t involve any costs, and using it may lead to noticeable savings in the long run. For starters, you pay no currency exchange fees when you receive payments in currencies that match your localized Borderless accounts. When your transactions involve the exchange of currencies, you benefit by getting TransferWise mid-market rates. Furthermore, TransferWise charges no fees when you add funds to your Borderless account unless you make a card payment. While you’ll need to pay fees to withdraw funds in your local bank account, these are nominal.

Coming Soon! A Multi-Currency Card

Later this year, TransferWise plans to better the Borderless Account by offering a multi-currency card. Hold tight! This card will give you the ability to hold funds in multiple currencies, which you can access globally, in different ways. International travelers might benefit by looking at what this card has to offer once it hits the market.

Conclusion

TransferWise has done well for its customers since it began operations and it continues using evolving technology to make international fund transfers simpler and more pocket-friendly. It has definitely scored a winner with the Borderless account, and its soon-to-be-launched multi-currency card has already garnered enough attention.

The Foreigners.cz team crosses its fingers to wish good luck to this bold, enterprising company!

Prepared in cooperation with Jon Dela Cruz.

Thanks for sharing this informative blog.

Suggest me some steps what to do if dell laptop plugged in but not charging my laptop was dead and don’t know how to fix this problem. Then i see this homepage and excited to learn all the steps for free and manage to fix my system.